When evaluating investment opportunities, one of the most crucial metrics you’ll encounter is the Internal Rate of Return (IRR). But what exactly is IRR, and why is it so important?

Understanding IRR is essential for making informed investment decisions. It provides a clear and concise way to evaluate the potential profitability of projects and investments, helping businesses and individuals allocate resources more effectively. While it has limitations, IRR is a powerful tool used correctly in the financial analyst’s toolkit.

Let’s dive into finance to understand this essential concept, how it’s calculated, and how it can be used to make smarter investment decisions.

What is IRR? What is the definition of IRR(Internal Rate of Return)?

The Internal Rate of Return (IRR) is a financial metric used to evaluate the profitability of an investment. The discount rate equals the net present value (NPV) of all cash flows from a particular project to zero. In simpler terms, IRR is the rate at which an investment breaks even in terms of NPV.

How IRR is Used in Finance?

IRR is a popular tool among investors and financial analysts because it provides a single number that summarizes the potential profitability of a project. It’s widely used in capital budgeting to assess the attractiveness of investments or projects.

The Importance of IRR Decision-Making in Investments

One of the primary reasons IRR is so important is its role in decision-making. When evaluating multiple investment opportunities, businesses and investors often look at the IRR to determine which projects are worth pursuing. A project with a higher IRR is more desirable.

Comparing Investment Opportunities

IRR allows investors to compare the profitability of different projects directly. By calculating the IRR for each project, investors can rank them and decide where to allocate their resources for the best returns.

How to Calculate IRR Basic Concept?

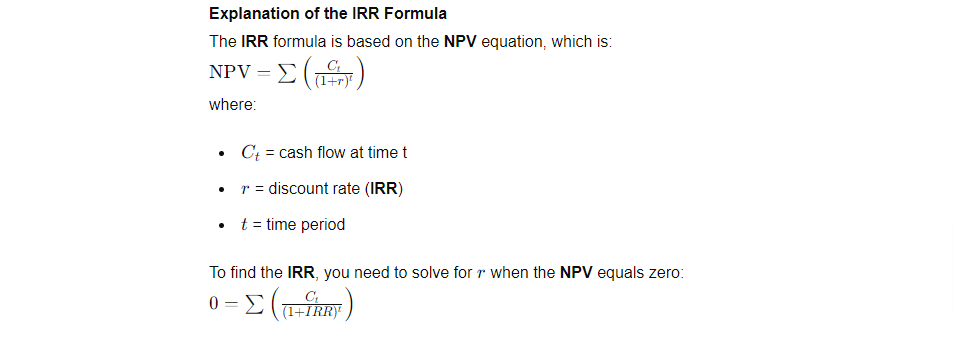

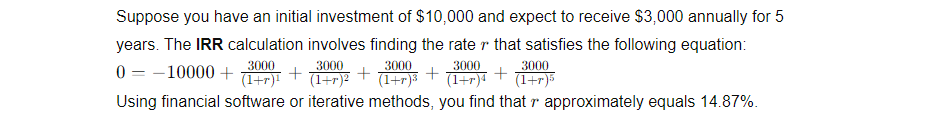

The basic concept behind calculating IRR is to find the discount rate that sets the NPV of all future cash flows to zero. This involves trial and error, as IRR is not typically solved through a straightforward formula but rather through iterative methods.

Detailed Steps in Calculation

- List all cash flows: Identify all expected cash inflows and outflows over the life of the investment.

- Choose a discount rate: Start with an estimated discount rate.

- Calculate NPV: Using the chosen discount rate, calculate the NPV of the cash flows.

- Adjust the rate: If the NPV is not zero, adjust the discount rate and repeat the calculation until the NPV is as close to zero as possible.

Formula for IRR

Example Calculation

Using Financial Calculators and Software Tools for Calculating IRR

Financial calculators and software such as Excel, Google Sheets, or specialized financial tools can simplify IRR calculations. They use iterative algorithms to find the IRR quickly.

Pros and Cons of Using Calculators and Software

| Pros | Cons |

| Speed and efficiency | Dependence on technology |

| Reduced chance of manual errors | Potential for misunderstanding the underlying calculation process |

| Ability to handle complex cash flow patterns |

Manual Calculation of IRR Step-by-Step Manual Calculation

For those who prefer to understand the mechanics, here’s a simplified manual approach:

- Estimate a range for the IRR.

- Calculate the NPV for each rate within this range.

- Narrow the range until the NPV is zero or very close to it.

Trial and Error Method

This method involves guessing a rate, calculating the NPV, and adjusting the rate up or down based on whether the NPV is positive or negative, repeating until you hone in on the IRR.

IRR vs. Other Financial Metrics Comparison with NPV (Net Present Value)

While NPV gives the absolute value of returns, IRR provides a percentage return, making it easier to compare different-sized projects. However, NPV can be more reliable for decision-making as it considers the scale of investment.

Comparison with ROI (Return on Investment)

ROI measures the gain or loss generated by an investment relative to its cost. Unlike IRR, ROI doesn’t account for the time value of money, which can lead to less accurate comparisons.

Advantages of Using IRR Simplicity and Intuitiveness

IRR is easy to understand and communicate. It gives a straightforward percentage that indicates the expected profitability of an investment.

Universality Across Projects

IRR can be applied to any investment, whether a small project or a large-scale corporate initiative, making it a versatile tool in financial analysis.

Limitations of IRR Multiple IRRs Issue

In cases where the cash flow pattern changes direction more than once (e.g., from positive to negative to positive), multiple IRRs can complicate the decision-making process.

Dependence on the Timing of Cash Flows

IRR assumes that interim cash flows are reinvested at the same rate, which might not be realistic. It can also be skewed by the timing of cash flows, potentially leading to misleading results.

Real-World Applications of IRR Corporate Finance

Corporations use IRR to evaluate the feasibility of projects, whether it’s for expanding operations, launching new products, or entering new markets. IRR helps compare potential returns against the company’s capital cost.

Personal Investment Decisions

Individuals use IRR to assess the attractiveness of personal investments such as real estate, stock portfolios, or retirement funds. It helps understand the expected rate of return over time.

IRR in Project Management Evaluating Project Feasibility

Project managers use IRR to decide whether a project is worth pursuing. A project with an IRR higher than the required rate of return is generally feasible.

Performance Measurement

It is also used to measure the performance of completed projects, comparing the actual returns against the projected IRR to gauge success.

Common Mistakes in IRR Calculation Incorrect Assumptions

Assuming incorrect cash flows or failing to account for all relevant inflows and outflows can lead to inaccurate IRR calculations.

Ignoring Cash Flow Variability

Not considering the variability and uncertainty in cash flows can result in misleading IRR values, impacting investment decisions.

Tips for Accurate IRR Calculation Ensuring Accurate Cash Flow Data

Collecting and verifying accurate cash flow data is crucial for reliable IRR calculations. Ensure all relevant cash flows are included and accounted for.

Regular Review and Adjustment

Regularly reviewing and adjusting the IRR calculations as new information becomes available helps maintain the accuracy and relevance of the investment analysis.

FAQs

What is the difference between IRR and NPV?

IRR is the discount rate that makes the NPV of cash flows zero, giving a percentage return, while NPV provides the total value of returns in monetary terms, considering the scale of the investment.

Can IRR be negative?

Yes, IRR can be negative if the project’s cash flows are insufficient to recover the initial investment, indicating a loss rather than a profit.

How often should IRR be calculated?

IRR should be calculated whenever there are significant changes in the expected cash flows or at regular intervals to assess the ongoing viability of an investment.

Is a higher IRR always better?

Not necessarily. While a higher IRR indicates higher potential returns, it’s also important to consider the scale of the investment, risk factors, and other financial metrics.

How does IRR affect decision-making in personal finance?

IRR helps individuals compare the expected returns of various investment opportunities, guiding them in making decisions that align with their financial goals and risk tolerance.